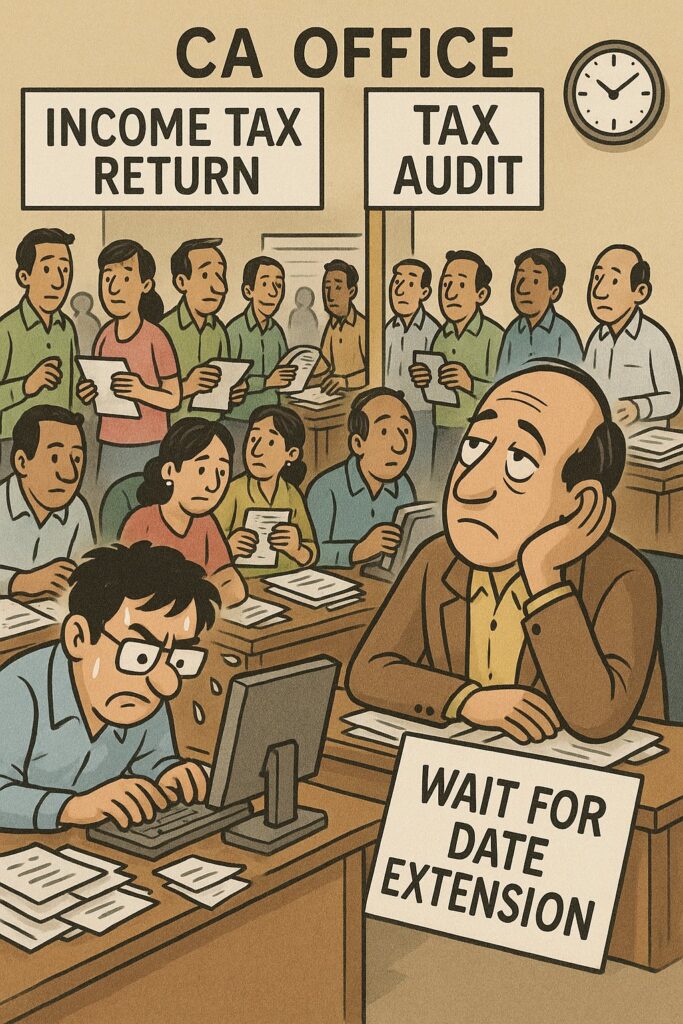

Rising Concerns Over ITR Filing Chaos

As the annual Income Tax Return (ITR) filing season reaches its peak, lakhs of taxpayers across India are voicing frustration over persistent glitches on the government’s e-filing portal. The All Tax Bar Association (ATBA), representing tax professionals, chartered accountants, and legal experts, has formally urged the Union Ministry of Finance to extend the deadline for filing returns until October 15, 2025.

According to the body, the current deadline is impractical given the validation errors, frequent session timeouts, and painfully slow upload speeds being reported by users across the country. ATBA insists that the extension is not about delaying compliance, but ensuring that taxpayers are not unfairly penalized for technical shortcomings beyond their control.

The Current Deadline and Mounting Pressure

The standard ITR filing deadline for most individuals and small businesses remains September 30, 2025. With only weeks left, tax practitioners complain that instead of focusing on accurate filing, they are wasting precious time trying to troubleshoot repeated errors thrown up by the system.

A chartered accountant from Delhi shared, “Every time I attempt to validate client data, the system either freezes or returns an unexplained error. Uploading even a small file sometimes takes up to half an hour. These delays are eating into working hours and adding enormous stress.”

The ATBA argues that such technical failures make the September 30 cut-off date unrealistic. Hence, they have requested an additional 15 days, pushing the deadline to October 15, to provide breathing space for both professionals and ordinary taxpayers.

Issues Plaguing the ITR Portal

Since the government launched the revamped e-filing portal, it has often been under the scanner for performance concerns. While improvements have been rolled out over the years, the current filing season has highlighted persistent bottlenecks.

The major problems cited by taxpayers include:

1. Validation Errors – Even when correct information is entered, the system rejects data with unexplained or false validation prompts.

2. Slow Upload Speeds – Uploading forms, bank statements, or supporting documents takes significantly longer than normal, leading to repeated attempts.

3. Session Timeouts – Users are logged out automatically while mid-way through filling forms, forcing them to restart.

4. Digital Signature Mismatches – Professionals using DSCs (Digital Signature Certificates) report mismatched signatures despite proper installation.

5. Delayed Acknowledgments – Even after successful filing, acknowledgment receipts (ITR-V) are delayed, leaving taxpayers uncertain about the submission status.

For small taxpayers or those with limited digital literacy, these glitches create additional dependency on professionals, thereby raising compliance costs.

ATBA’s Letter to the Government

In its official communication to the Finance Ministry and the Central Board of Direct Taxes (CBDT), the ATBA has emphasized that taxpayers should not be penalized for technical hurdles beyond their control.

The letter highlights:

Unfair Penalties: If the deadline is not extended, many taxpayers may miss filing and attract late fees, interest, or even notices from the department.

Professional Overload: Chartered accountants and tax practitioners are struggling with huge workloads compounded by repeated system failures.

Equity and Justice: Tax compliance should be fair and transparent, not a race against faulty digital infrastructure.

The association urged the government to show sensitivity towards the concerns of millions of taxpayers and extend the deadline to October 15, which would allow smoother compliance.

Taxpayer Voices: Stress and Uncertainty

Beyond professional circles, individual taxpayers are also feeling the heat. Many complain that what should be a straightforward digital process has turned into a test of patience.

- “I logged in three times last night, but the portal kept throwing server errors. I finally gave up after midnight,” said a salaried professional from Mumbai.

- “I run a small business. I don’t have time to keep retrying uploads all day. Every wasted hour costs me,” said a shop owner in Bengaluru.

- “The government talks about Digital India, but when the most crucial portal fails in crunch time, it breaks our trust,” added a young freelancer from Kolkata.

These personal stories underline the human cost of technical inefficiencies. The stress of potential penalties, coupled with wasted hours and late nights, is draining taxpayers during an already demanding season.

Government’s Past Approach to Deadline Extensions

Historically, the government has occasionally extended ITR filing deadlines in response to public demand, particularly when faced with exceptional circumstances.

In 2020 and 2021, during the COVID-19 pandemic, deadlines were extended multiple times due to logistical challenges.

Even in 2022 and 2023, short extensions were granted after complaints about technical glitches.

However, in recent years, the Ministry of Finance has taken a stricter stance, urging taxpayers to file well in advance and resisting extensions to avoid last-minute surges. Officials argue that constant extensions encourage laxity and defeat the purpose of timely compliance.

That said, pressure from professional bodies like ATBA has historically played a role in influencing government decisions.

Experts Weigh In: Balancing Compliance with Practicality

Experts are divided on the issue of extending the deadline.

Pro-extension voices argue that it is a matter of fairness. If the government mandates digital compliance, it must also ensure that digital infrastructure functions smoothly. Penalizing taxpayers for system errors is unjust.

Anti-extension voices say that extensions create complacency, with many taxpayers deliberately waiting till the last minute, thereby worsening the load on the system.

A tax policy analyst explained, “The government has to strike a balance. A short extension may ease immediate stress, but it must also come with assurances that system capacity will be upgraded to handle peak loads.”

The Scale of the Challenge

India has one of the largest taxpayer bases in the world, with over 7.5 crore returns expected to be filed this season. The challenge of handling such massive digital traffic, especially in the final weeks of September, is formidable.

Industry insiders suggest that even a 10% system failure rate translates into lakhs of taxpayers being affected. This not only disrupts compliance but also generates a flood of grievances for the tax department to resolve later.

Possible Government Response

While the government has not yet officially commented on ATBA’s request, insiders suggest that the Finance Ministry is closely monitoring portal performance and may take a decision closer to the deadline.

Officials are reportedly weighing two options:

1. A short extension (till October 7–10) to provide temporary relief.

2. A full extension till October 15, as demanded by ATBA, to completely absorb the pressure of delayed filings.

However, sources also indicate that the Ministry does not want to set a precedent of routine extensions every year. The decision, therefore, may depend on whether portal performance stabilizes in the coming weeks.

What Happens if Deadline Isn’t Extended?

- If the September 30 deadline holds firm, taxpayers who miss it will face:

- Late filing fee under Section 234F of the Income Tax Act (up to ₹5,000 depending on income level).

- Interest on outstanding tax dues for delayed filing.

- Reduced time for revisions in case of errors.

- Loss of certain benefits, such as carrying forward of losses.

- For many small businesses and salaried individuals already dealing with inflation and financial pressures, these penalties could add an additional burden.

Larger Debate: Is India’s Tax Tech Future-Ready?

The controversy also raises broader questions about India’s digital tax infrastructure. While the government has invested heavily in automation, AI-powered processing, and real-time data integration, the system still struggles under peak loads.

Experts argue that better load testing, phased deadlines, and user-friendly interfaces could prevent such yearly chaos. Some have even suggested a staggered deadline approach based on income categories, ensuring that not all taxpayers are forced to file in the same window.

ATBA’s Larger Mission

For ATBA, the demand for deadline extension is part of its wider role as a watchdog for taxpayer rights. Over the years, the association has consistently flagged issues related to procedural fairness, excessive compliance burdens, and lack of clarity in circulars.

Their current demand, therefore, reflects not just the urgency of this filing season, but also a deeper concern about trust and transparency in India’s tax regime.

Waiting for Clarity

With just weeks left until the September 30 deadline, the ball now lies in the government’s court. Will it heed ATBA’s call and extend the deadline to October 15, giving taxpayers a breather? Or will it stick to its tough stance, insisting that compliance must not be delayed?

For now, taxpayers and professionals alike are anxiously refreshing the portal—and hoping not just for smoother uploads, but also for a timely and compassionate decision from the authorities.

Related News: Read More